胶水厂家

uv胶水生产厂家及密封胶胶水AB结构胶

更多nfc,RFID标签,rfid,请联系

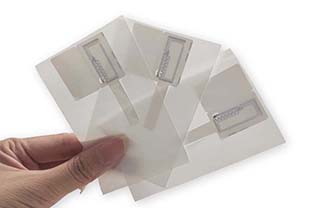

RFID, RFID electronic tags, RFID technology, NFC,Small batch customization

NFC, RFID tags, RFID, RFID technology, automatic identification, RFID, electronic tag customization

ABOUT

We are a high-tech enterprise specializing in the research and development, production, and sales of RFID tags, RFID, RFID electronic tags, RFID technology, NFC, RFID readers and writers, RFID asset management systems, RFID cards, and RFID devices. We are one of the production enterprises of smart cards and reading and writing devices with huge strength in China. Smart Card Technology Co., Ltd. has long been committed to the development and application of RFID technology, and has established partnerships with companies such as PHILIPS, ATMEL SIEMENS, MOTOROLA, ISSI, Fudan Electronics, Tsinghua Tongfang, and Dongda Alpi, providing excellent solutions for electronic payments, identity recognition, intelligent anti-counterfeiting, and goods tracking. We have developed excellent solutions for electronic payments, identity recognition, intelligent anti-counterfeiting, and goods tracking. Animal electronic ear tags RFID tags, RFID handheld terminals, automatic device recognition systems, asset tracking management systems, electronic ticket systems, dozens of new products with independent intellectual property rights. At the same time, we can also customize and develop personalized products for customers, and provide comprehensive solutions for integrating various industry systems.

Thanks to the kindness and support of people from all walks of life, all employees of RFID electronic tag company will double their efforts to give you feedback with higher quality products and more comprehensive services. RFID tags, RFID, RFID electronic tags, RFID technology, NFC, RFID readers, RFID asset management systems, RFID cards, and RFID devices

The Development History of RFID Technology’s Responder Smart Tags and What Are Dry and Wet INLAYs

RFID Technology’s Responder Smart Tag

The advantages and applications of RFID windshield tags

The advantages and applications of RFID windshield tags RFID windshield tag is an electronic tag based on radio frequency identification technology, mainly used in the

RFID radio frequency identification technology helps inspection vehicles achieve path recognition

RFID radio frequency identification technology helps inspection vehicles achieve path recognition In order to accelerate enterprise transformation and improve production efficiency, many enterprises have introduced

A Security Management System for RFID Application Examination Papers

A Security Management System for RFID Application Examination Papers In today’s era of informatization, networking, and intelligence, the holding of important exams such as the

The characteristics of industrial grade rfid reader writer

The characteristics of industrial grade rfid reader writer Industrial grade RFID readers and writers are generally applied in the industrial field. The industrial environment is

The Application of RFID Animal Tags in Animal Management

The Application of RFID Animal Tags in Animal Management RFID technology is not only applied in various fields of human life, but also in the

The Application of RFID Inventory Counting in RFID Asset Management System

The Application of RFID Inventory Counting in RFID Asset Management System Traditional inventory counting usually requires manual scanning of item barcodes one by one and

Selection Elements of RFID Printers in the Industrial Manufacturing Field of Rfid Electronic tag Manufacturers

Selection Elements of RFID Printers in the Industrial Manufacturing Field of Rfid Electronic tag Manufacturers In the manufacturing industry, such as home appliance manufacturing, mechanical